Navigating Market Volatility – April 2025

Navigating Market Volatility – April 2025

Market Volatility – April 2025

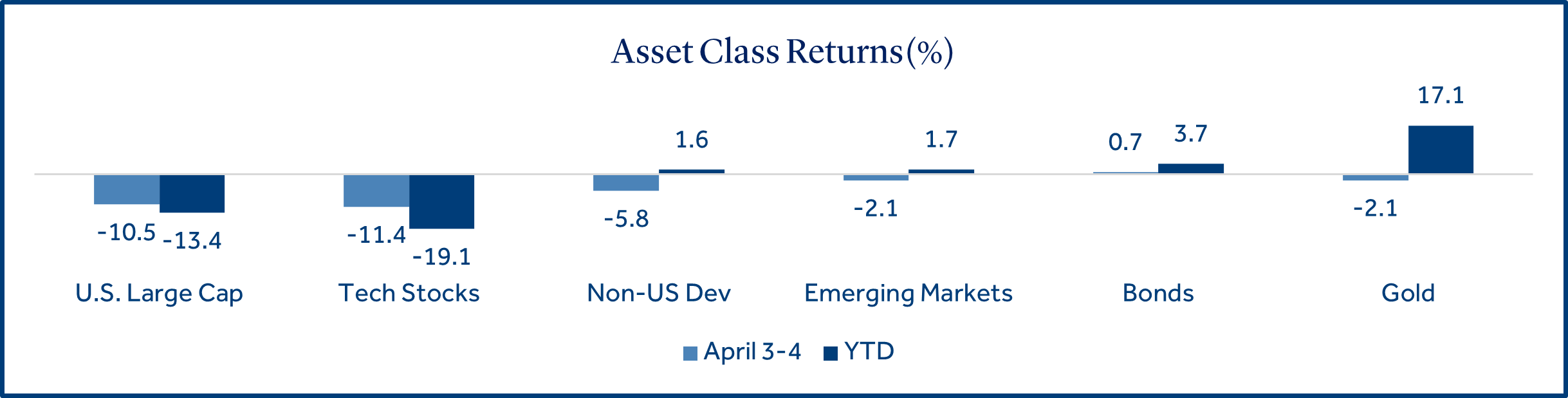

New U.S. tariffs re-ignite stock market volatility. U.S. stock markets declined by –10.5% in total on Thursday and Friday in reaction to new U.S. tariffs that will impact trade with “virtually every country in the world”. The S&P 500 Index has now declined –17.3% since its all-time high of 6147 on February 19th. The volatility continued into Monday April 7th, with U.S. stocks declining as much as -5% in early trading.

The benefits of portfolio diversification have been evident during the selloff. While U.S. stocks have suffered in 2025, international stocks, bonds and some commodities have been more resilient, highlighting the value of diversification.

We knew the tariffs were coming. Why is the stock market responding this way?

-

Tariffs were larger than expected. A baseline tariff of 10% was enacted on foreign countries with a trade surplus with the U.S. Additional reciprocal tariffs, ranging from 11% to 50%, were levied on more than fifty countries that charge tariffs on U.S. imports. Reciprocal tariffs on some large U.S. trading partners include the Eurozone (20%), China (34%), Japan (24%), Vietnam (46%), and India (26%)1.

-

Tariffs were not empty threats and appear to be a key piece of policy agenda. The tariffs that were forewarned were carried out, highlighting that they were not simply a negotiating tactic. Investors are now concerned tariffs could slow business spending and consumer demand, resulting in a period of slower economic growth and higher unemployment in the U.S.

-

Businesses and consumers may come under greater stress. The impact of recently enacted tariffs on U.S. corporations cannot be fully understood at this time. The uncertainty caused by new policies has caused analysts to reassess corporate earnings forecasts for 2025. Further, the short-term impact of tariffs on the price of goods and services for U.S. consumers is unknown.

How are tariffs affecting different asset classes, sectors, and regions?

-

Growth and momentum-oriented stocks have underperformed. Areas of the market that performed well in 2024 have declined the most in 2025. While the S&P 500 has returned -13.4%, year-to-date, the “magnificent seven” stocks (Alphabet, Amazon, Apple, Meta, Microsoft, NVIDIA, and Tesla) collectively declined -24% over the same period.

-

Higher yielding defensive sectors have outperformed. Higher yielding sectors like consumer staples (+1.3%) and utilities (-0.8%) have provided investors with better protection during the selloff. The yield factor (-4.7%) has outperformed year-to-date as many investors have shifted to a more defensive posture.

-

Foreign stocks decoupled from U.S. stocks. International developed market stocks (MSCI EAFE Index) returned +1.6% outperforming the S&P 500, which returned -13.4% year-to-date, driven by a more favorable central banking environment abroad.

-

Bonds have benefited from flight to quality. The Bloomberg US Aggregate Bond Index returned +3.7% year-to-date, reflecting the safe-haven demand for fixed income instruments.

What positive events could bring stability to markets?

Although the situation currently looks dire, there are some key developments to watch for that may turn the tide for U.S. equity markets. Key events to monitor include:

-

Progress with tariff negotiations. It will be important to monitor how countries respond to the tariffs and negotiate with the U.S. There could also be potential for foreign companies to work directly with the U.S. government on making U.S. investments to avoid tariffs. It was reported on Friday, April 4 that Vietnam has approach the U.S. about negotiating a tariff deal.

-

Continued stability in U.S. economic data. New jobs created in March (+228,000) increased more than the forecast (+140,000) and were above the +117,000 jobs created in February. Interest rates have also declined in recent days, which may help lower borrowing costs, including mortgage rates.

-

Possible action by the Federal Reserve (the Fed) to calm markets. The last time U.S. stocks declined more than 10% over two trading days was during the COVID stock market decline in March 2020. At that time, the Fed acted quickly to cut interest rates and implement quantitative easing to provide liquidity and support the economy. Should tariff based volatility continue, the Fed may be compelled to take action to backstop the U.S. capital markets.

What actions should I take during this heightened market volatility?

-

Review asset allocations. Recheck portfolio asset allocation to ensure it is appropriately diversified and aligned with the investor’s age, risk tolerance, and financial goals.

-

Rely on professional asset management. Professional portfolio managers are equipped to navigate volatility, identify undervalued opportunities, and make tactical adjustments to mitigate downside risk.

-

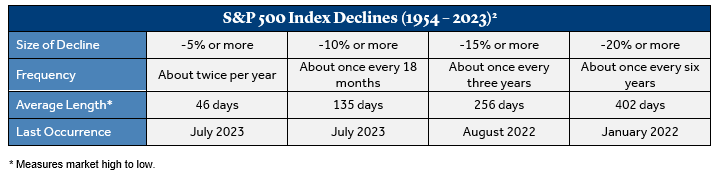

Maintain discipline and a long-term perspective. Market declines vary in magnitude and frequency, but they have been common throughout history and are generally temporary. Staying invested with a well-diversified portfolio is the key to success. A disciplined, diversified, and informed approach should help investors navigate current market conditions and position for future opportunities.

Click here for a downloadable version.

Data and rates used were indicative of market conditions as of the date shown. Opinions, estimates, forecasts, and statements of financial market trends are based on current market conditions and are subject to change without notice. This material is intended for general public use and is for educational purposes only. By providing this content, Park Avenue Securities LLC is not undertaking to provide any recommendations or investment advice regarding any specific account type, service, investment strategy or product to any specific individual or situation, or to otherwise act in any fiduciary or other capacity. Please contact a financial professional for guidance and information that is specific to your individual situation. Indices are unmanaged and one cannot invest directly in an index. Links to external sites are provided for your convenience in locating related information and services. Guardian, its subsidiaries, agents, and employees expressly disclaim any responsibility for and do not maintain, control, recommend, or endorse third-party sites, organizations, products, or services and make no representation as to the completeness, suitability, or quality thereof. Past performance is not a guarantee of future results.

All investments involve risks, including possible loss of principal. Equities may decline in value due to both real and perceived general market, economic, and industry conditions. Fixed income securities involve interest rate, credit, inflation, and reinvestment risks, and possible loss of principal. As interest rates rise, the value of fixed income securities falls. Low-rated, high yield bonds are subject to greater price volatility. Investing in securities of smaller companies tends to be more volatile and less liquid than securities of larger companies. Investing in foreign securities may involve heightened risk including currency fluctuations, less liquid trading markets, greater price volatility, political and economic instability, less publicly available information and changes in tax or currency laws. Such risks are enhanced in emerging markets.

Returns sourced from Morningstar Direct. Asset categories listed correspond to the following underlying indices: U.S. Large Cap (S&P 500 Index), Tech Stocks (Nasdaq Composite), Yield factor (Russell 1000 Yield Factor), Non-US Dev (MSCI EAFE), Emerging Markets (MSCI EM), Bonds (Bloomberg US Aggregate Bond), Gold (LBMA Gold Price), consumer staples (S&P 500 Sector / Cons Staples), utilities (S&P 500 Sector / Utilities).

1 Source: Bloomberg

2 Source: Capital Group, RIMES, Standard & Poor’s

S&P 500 Index: Index is generally considered representative of the stock market as a whole. The index focuses on the large-cap segment of the U.S. equities market.

MSCI EAFE Index: Index measures the performance of the large and mid-cap segments of developed markets, excluding the U.S. & Canada.

MSCI EM Index: Index Measures the performance of the large and mid-cap segments of emerging market equities.

Bloomberg US Aggregate Bond Index: Index measures the performance of investment grade, U.S. dollar-denominated, fixed-rate taxable bond market, including Treasuries, government-related and corporate securities, MBS, ABS, and CMBS.

Park Avenue Securities LLC (PAS) is a wholly owned subsidiary of The Guardian Life Insurance Company of America (Guardian). 10 Hudson Yards, New York, NY 10001. PAS is a registered broker-dealer offering competitive investment products, as well as a registered investment advisor offering financial planning and investment advisory services. PAS is a member of FINRA and SIPC.

PAS018195-APRIL

7069921.10 (Exp. 04/2027)