Monthly Market Commentary - November 2024

Monthly Market Commentary - November 2024

Market Update

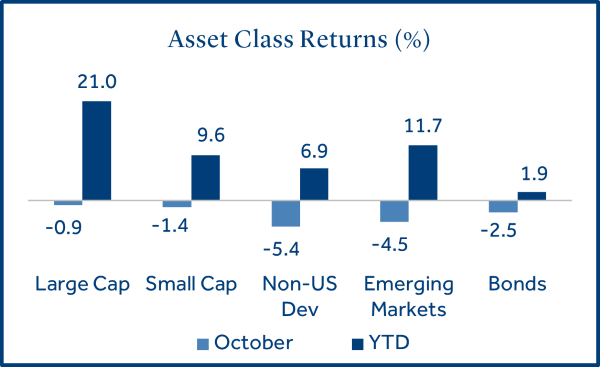

Major asset class returns were broadly negative in October after a late pullback.

While many investors believed the September rate cut would support a further rally in stocks and bonds, asset class returns were mostly lower in October. Leading up to the Federal Reserve’s (Fed’s) -0.50% cut, treasury yields had declined for five consecutive months. However, despite the Fed’s action, long-term interest rates increased in October and served as a headwind to risk assets. Against this backdrop:

- Large cap stocks continued to outperform small cap stocks: Large caps (S&P 500 Index) returned -0.9% and outperformed small caps (Russell 2000 Index), which lost -1.4%. Growth stocks outperformed value stocks, and financials represented the strongest sector.

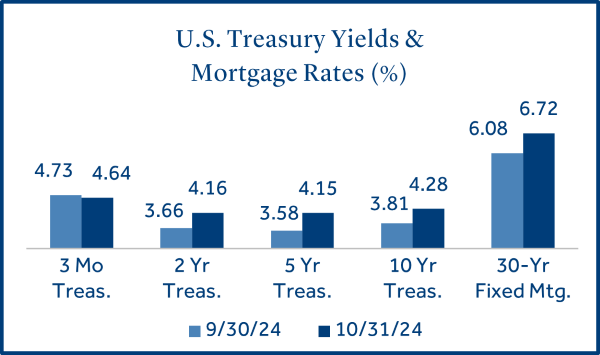

- Bonds broke a five-month win streak as Treasury yields rose: Bonds (Bloomberg US Aggregate Bond Index) returned -2.5% as long-term interest rates moved higher. The 10-year U.S. Treasury yield increased from 3.81% to 4.28% (+0.47%) in October.

- Foreign stocks underperformed domestic stocks: Emerging Market equities (MSCI EM Index) declined -4.5% and outperformed non-U.S. developed market stocks (MSCI EAFE Index) which lost -5.4%. French stocks (-6.4%) led developed markets lower as France’s credit outlook was revised to “negative” from “stable” by Moody’s Ratings due to growing concerns around the budget deficit1.

U.S. Equities

The S&P 500 hit a series of all-time highs in October but ended the month lower on mixed earnings results.

The rally in stocks continued through mid-October but rising bond yields and mixed earnings results led to a modest pullback at month end. As the S&P 500 is near record highs, valuations have expanded.

- Equity valuations remain elevated: The price-to-earnings ratio (P/E ratio) for the S&P 500 Index has expanded from 19.5 at the start of the bull market (October 2022), to 27.5 at the end of September2. The currently higher valuations are not by themselves a reason to avoid stocks, but they should be considered when assessing portfolio risk.

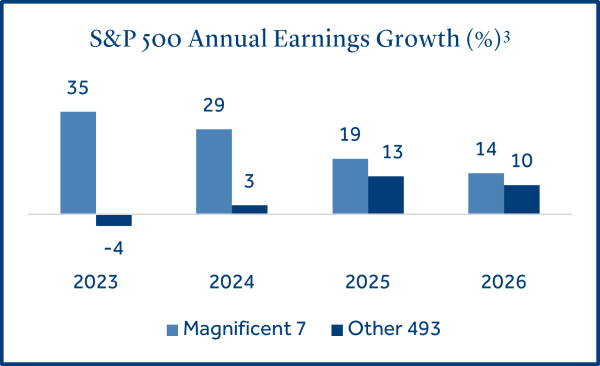

- Third quarter profits for S&P 500 firms have been mixed: As valuations expand, earnings (profits) growth will be especially important to support a further rally in stocks. 70% of firms within the index have reported earnings results, with 75% exceeding estimates (this is slightly below the 5-year average of 77%).

- Earnings breadth is expected to widen: The Magnificent 7 stocks (Amazon, Apple, Alphabet, Meta, Microsoft, NVIDIA, and Tesla) accounted for nearly 40% of the S&P 500 return year-to-date3. This may be justified due to their outsized earnings growth but a recent analysis from Goldman Sachs forecasts the earnings premium for these stocks to decline, potentially opening the door to new leadership within equites.

Fixed Income

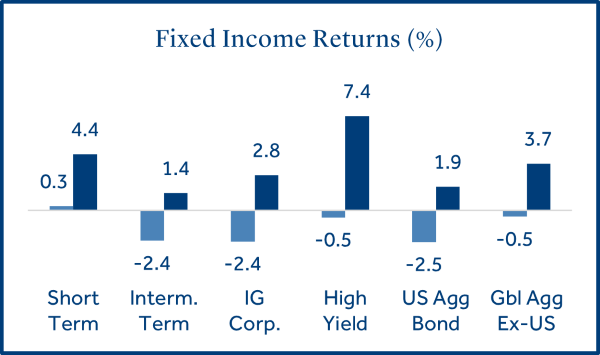

A rapid rise in bond yields sent most fixed income sectors lower during the month.

The optimistic explanation for rising yields reads “the U.S. economy continued to grow, and the job market remains strong”. The negative viewpoint is “the budget deficit is growing, and monthly inflation has been worse than expected”. We can debate exactly why interest rates rose, but the results were as follows:

- Short duration bonds post positive gains: The Fed cut short-term rates in September, but longer-term yields rose as they are more responsive to economic factors. This hindered longer-term bond returns and led to a rise in mortgage rates, as home sales dropped to their slowest pace since 2010.

- High yield (HY) bonds cushioned U.S. fixed income returns: HY bonds (rated BB and below) carry higher credit (default) risk versus investment grade (IG) bonds. Due to their higher credit risk, HY bonds generally have shorter maturities, making them less sensitive to rising interest rates.

Federal Reserve

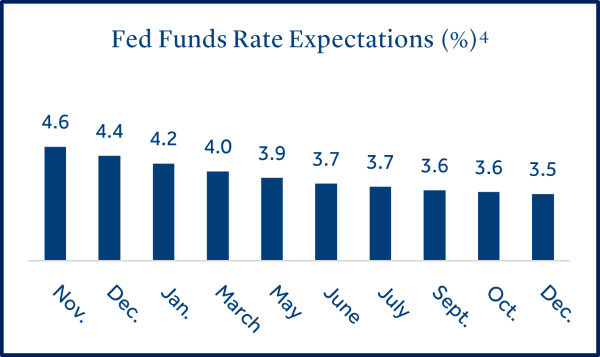

The Fed is expected to cut short-term interest rates by -0.25% during their November policy meeting.

Economic data has been better than expected since the Fed’s initial rate cut of -0.50% in September, and many investors now expect monetary easing to continue at a more gradual pace going forward.

- Fed members favor patience for future rate cuts: Several regional members of the FOMC have stated their support for “gradual rate cuts”. Raphael Bostic (Atlanta) stated “he is not in a hurry to lower interest rates” as policymakers are committed to achieving 2% inflation. Neel Kashkari (Minneapolis) reiterated a preference to “reduce rates at a slower pace in the coming quarters” and Jeffrey Schmid (Kansas City) said he “favors a slower pace of rate reductions” given the economic uncertainty4.

- The Fed’s survey of economic conditions showed little change: Also known as the “Beige Book”, the report of economic conditions indicated activity was little changed since early September. This suggests the economy may not be as strong as other economic data has indicated and supports the Fed view that risks to economic growth and inflation are in balance.

- Interest rate futures markets are projecting the Fed to cut rates by -0.25% in November5: There is currently a 99% probability of a -0.25% rate reduction at the Fed meeting in November, with incremental reductions expected through the end of 2025.

U.S. Presidential Election

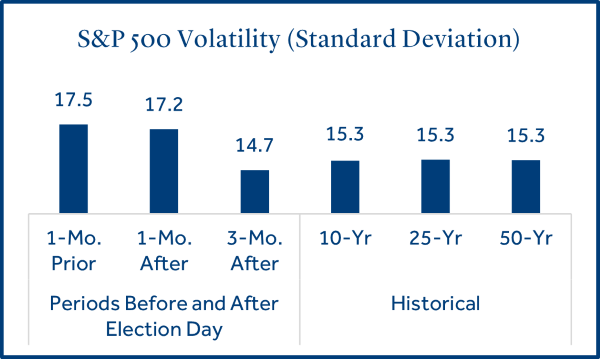

Market volatility has been higher in periods around U.S. presidential elections.

The uncertainty that we all feel around presidential elections has contributed to higher market volatility around these events. In most cases, the volatility quickly subsides and provides entry points for opportunistic investors. The following themes have persisted during election periods.

- Stocks have experienced higher volatility around presidential elections: A recent study analyzed the last 24 U.S. presidential elections. On average, equity market volatility was higher in the months immediately before and after the elections6.

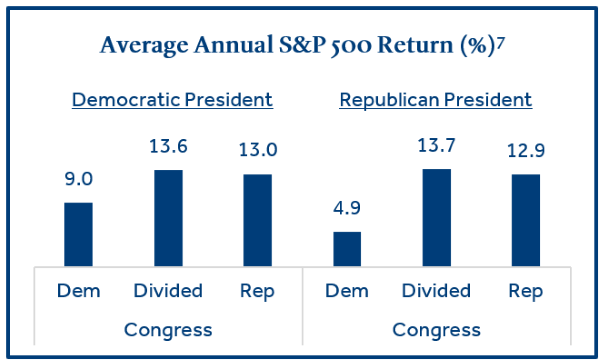

- Stocks have delivered their best returns under a divided congress: Congress is currently divided as Democrats control the senate and Republicans control the house. Although control from a single party can lead to easier policy enactment, historical data indicates higher equity returns when congress is divided.7

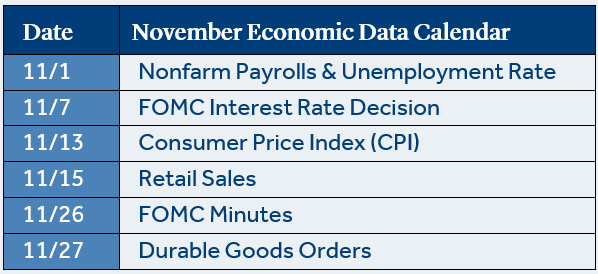

Economic Calendar

U.S. job growth reaccelerated in October and the unemployment rate declined.

The U.S. economy remained steady during October as job growth was strong, consumer spending was higher than forecasted, and annualized inflation (CPI) continued its recent downward trajectory.

- U.S. job growth surged in September: +223k new jobs were added during the month, which was well above analyst estimates (+140k). The unemployment rate ticked lower by -0.1% to 4.1% and has now declined for two consecutive months. October jobs data was released on November 1 and only reflected +12k new jobs (below the forecast of +100k). However, there were expectations this report could be an outlier due to the Boeing strike and recent hurricanes in the U.S.

- Retail sales notched their third consecutive monthly increase: Sales increased +0.4% for the month and exceeded estimates (+0.3%). Consumers remained resilient as discretionary spending at restaurants and clothing retailers boosted overall sales. Gasoline prices have steadily declined from an average of $3.60 to $3.22 a gallon over the last three months and likely boosted spending power for consumers.

- Annualized inflation (CPI) declined for the sixth consecutive month: Monthly inflation increased +0.2% in September, matching the +0.2% increase in August, but annualized inflation fell to +2.4% and was slightly above expectations (+2.3%). Similar to August, higher shelter related costs were a significant driver of the monthly increase.

To download the printable version, CLICK HERE.

Data and rates used were indicative of market conditions as of the date shown. Opinions, estimates, forecasts, and statements of financial market trends are based on current market conditions and are subject to change without notice. This material is intended for general public use and is for educational purposes only. By providing this content, Park Avenue Securities LLC is not undertaking to provide any recommendations or investment advice regarding any specific account type, service, investment strategy or product to any specific individual or situation, or to otherwise act in any fiduciary or other capacity. Please contact a financial professional for guidance and information that is specific to your individual situation. Indices are unmanaged and one cannot invest directly in an index. Links to external sites are provided for your convenience in locating related information and services. Guardian, its subsidiaries, agents, and employees expressly disclaim any responsibility for and do not maintain, control, recommend, or endorse third-party sites, organizations, products, or services and make no representation as to the completeness, suitability, or quality thereof. Past performance is not a guarantee of future results.

All investments involve risks, including possible loss of principal. Equities may decline in value due to both real and perceived general market, economic, and industry conditions. Fixed income securities involve interest rate, credit, inflation, and reinvestment risks, and possible loss of principal. As interest rates rise, the value of fixed income securities falls. Low-rated, high yield bonds are subject to greater price volatility. Investing in securities of smaller companies tends to be more volatile and less liquid than securities of larger companies. Investing in foreign securities may involve heightened risk including currency fluctuations, less liquid trading markets, greater price volatility, political and economic instability, less publicly available information and changes in tax or currency laws. Such risks are enhanced in emerging markets.

Asset class returns sourced from Morningstar Direct. Asset categories listed correspond to the following underlying indices: Large Cap (S&P 500), Small Cap (Russell 2000), Non-US Dev (MSCI EAFE), Emerging Markets (MSCI EM), Bonds (Bloomberg US Aggregate Bond), Short Term (Bloomberg Short Treasury), Intermediate-term (Bloomberg US Treasury), IG Corp (Bloomberg US Corp. Bond), High Yield (Bloomberg High Yield Corporate), Global Agg ex-US (Bloomberg Global Agg Ex US – Hedged).

Treasury Yields sourced from the U.S. Department of the Treasury and the 30-Year Fixed Mortgage rate sourced from the Federal Reserve Bank of St. Louis.

Inflation (CPI) sourced from the U.S. Bureau of Labor Statistics.

1 Source: Reuters

2 Source: Morningstar

3 Source: Goldman Sachs Asset Management

4 Source: Bloomberg

5 Source: CME FedWatch Tool

6 Source: T. Rowe Price

7 Source: Fidelity Investments

The Consumer Price Index (CPI) examines the weighted average of prices of a basket of consumer goods and services, such as transportation, food and medical care and is a commonly used measure of the rate of inflation.

Retail Sales represents the level of retail sales directly to U.S. consumers.

Durable Goods measure the cost of orders received by U.S. manufacturers of goods meant to last at least three years.

Fund Funds Rate: Short-term target interest rate set by the Federal Open Market Committee (FOMC); the policy making committee of the Federal Reserve. It is the interest that banks and other depository institutions lend money on an overnight basis.

S&P 500 Index: Index is generally considered representative of the stock market as a whole. The index focuses on the large-cap segment of the U.S. equities market.

Russell 2000 Index: Index measures performance of the small-cap segment of the U.S. equity universe.

MSCI EAFE Index: Index measures the performance of the large and mid-cap segments of developed markets, excluding the U.S. & Canada.

MSCI EM Index: Index Measures the performance of the large and mid-cap segments of emerging market equities.

Bloomberg US Aggregate Bond Index: Index measures the performance of investment grade, U.S. dollar-denominated, fixed-rate taxable bond market, including Treasuries, government-related and corporate securities, MBS, ABS, and CMBS.

Park Avenue Securities LLC (PAS) is a wholly owned subsidiary of The Guardian Life Insurance Company of America (Guardian). 10 Hudson Yards, New York, NY 10001. PAS is a registered broker-dealer offering competitive investment products, as well as a registered investment advisor offering financial planning and investment advisory services. PAS is a member of FINRA and SIPC.

PASXXXXXX

2024-7069921.2 (Exp. 10/26)