Monthly Market Commentary - March 2025

Monthly Market Commentary - March 2025

Market Update

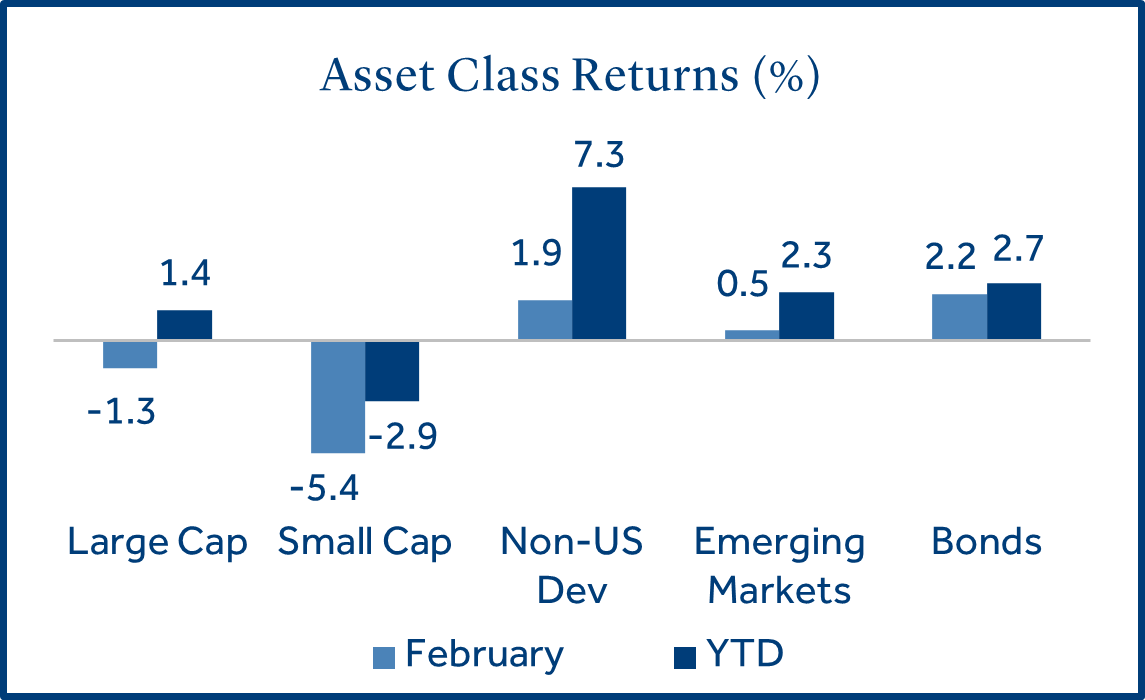

Bonds and international stocks led asset class returns in February.

The S&P 500 Index reached a new all-time high in February before retreating into month end. U.S. investor sentiment shifted due to slower job growth and weaker profit guidance from several large retail companies. U.S. bonds benefitted from lower yields while foreign stocks outperformed due to tailwinds of central bank activity and stronger earnings. Against this backdrop:

- U.S. stocks underperformed on economic growth concerns: Large cap stocks (S&P 500 Index) declined -1.3% but outperformed small caps (Russell 2000 Index) which lost -5.4%. The lagging U.S. returns were primarily driven by weaker job growth and consumer spending.

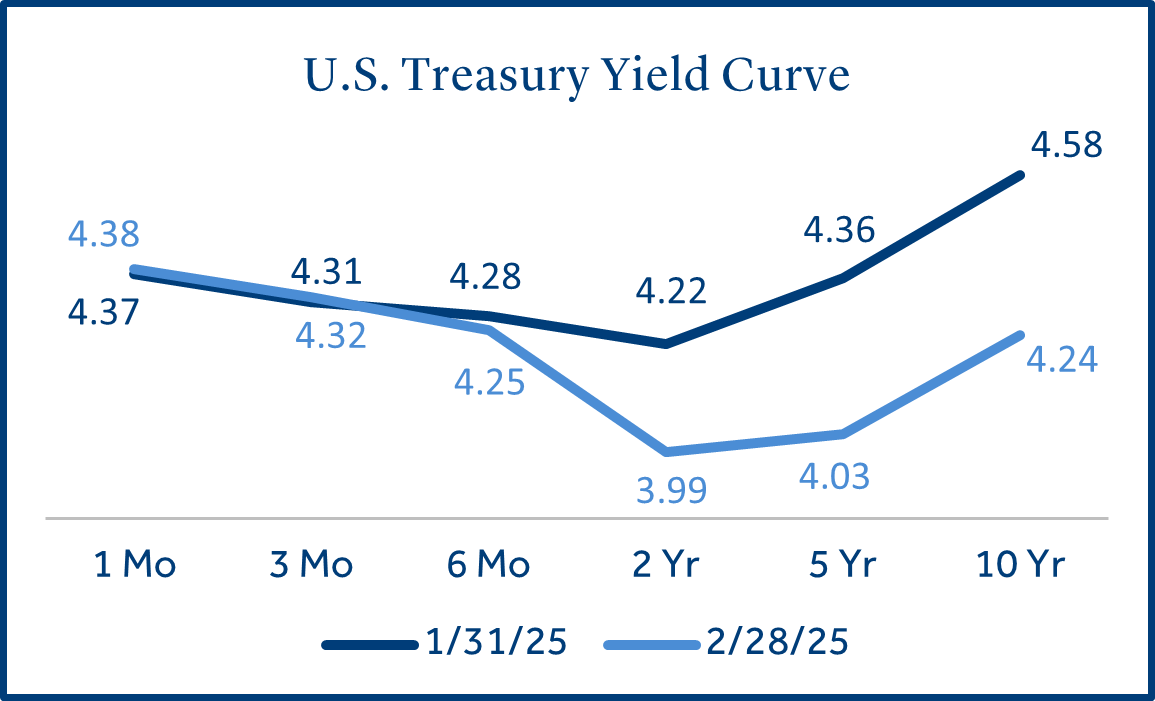

- Bonds posted positive gains as longer-term interest rates declined: Bonds (Bloomberg US Aggregate Bond Index) gained +2.2% as the 10-year U.S. Treasury yield dropped from 4.58% to 4.24% (-0.34%) in February.

- International equities continued to lead returns in 2025: Non-U.S. developed markets (MSCI EAFE Index) gained +1.9% and topped emerging markets (MSCI EM Index) which returned +0.5%. UK stocks (+3.5%) benefitted from a rate cut (-0.25%) and Chinese stocks (+11.8%) rose on upbeat corporate earnings.

Equities

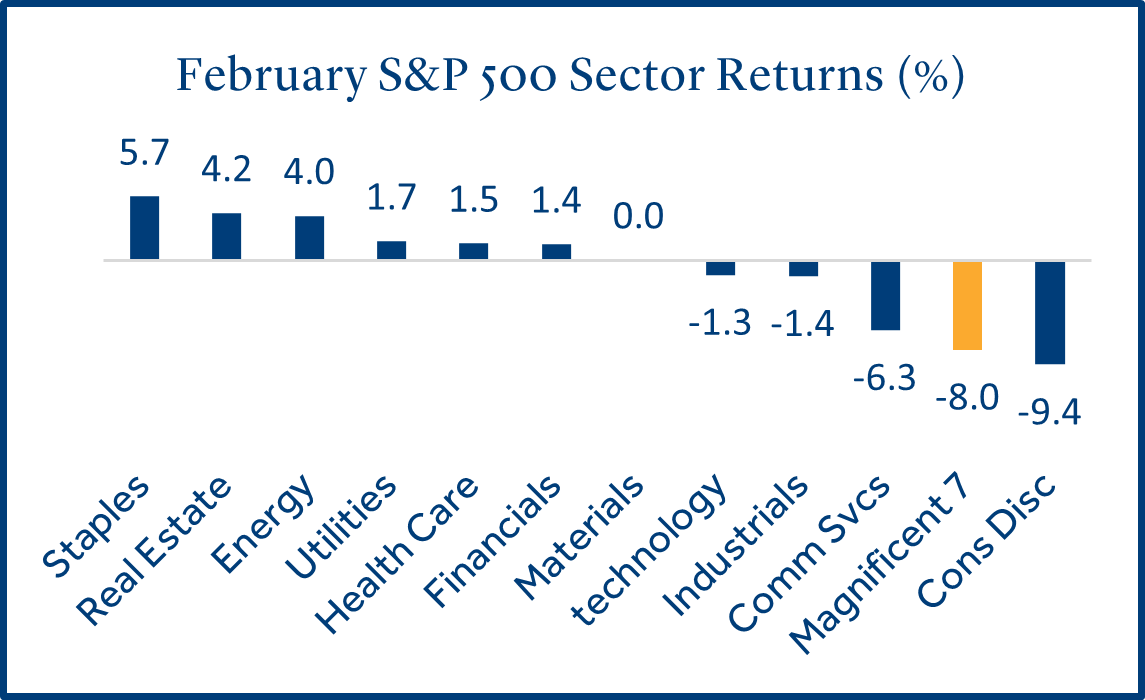

U.S. stocks trailed international stocks due to weaker profit guidance and uncertain economic policy.

International stocks have trailed U.S. stocks for most of the last decade but a strong start to 2025 has some investors reviewing international equity allocations.

- Magnificent seven stocks underperform in February: Magnificent seven stocks (Alphabet, Amazon, Apple, Meta, Microsoft, NVIDIA, and Tesla) collectively posted weak performance, declining -8.0% in February. Tesla (-27.6%), Alphabet (-16.2%) and Amazon (-10.7%) were the weakest performers of the group.

- Small cap stocks have declined as economic uncertainty has risen: The Russell 2000 Index has pulled back -10.9% since December 1st (the S&P 500 returned -1% during that time). Small caps have faltered as interest rates remain elevated, and small cap firms often rely more heavily on debt financing versus larger firms.

- International stocks got a boost from strong earnings and improving economic data: Recent economic data in Europe has exhibited strength in both the manufacturing and services sectors, which has resulted in higher corporate profits for many European firms. Additionally, European bank profits have hit record highs on supportive central bank policy.

Fixed Income

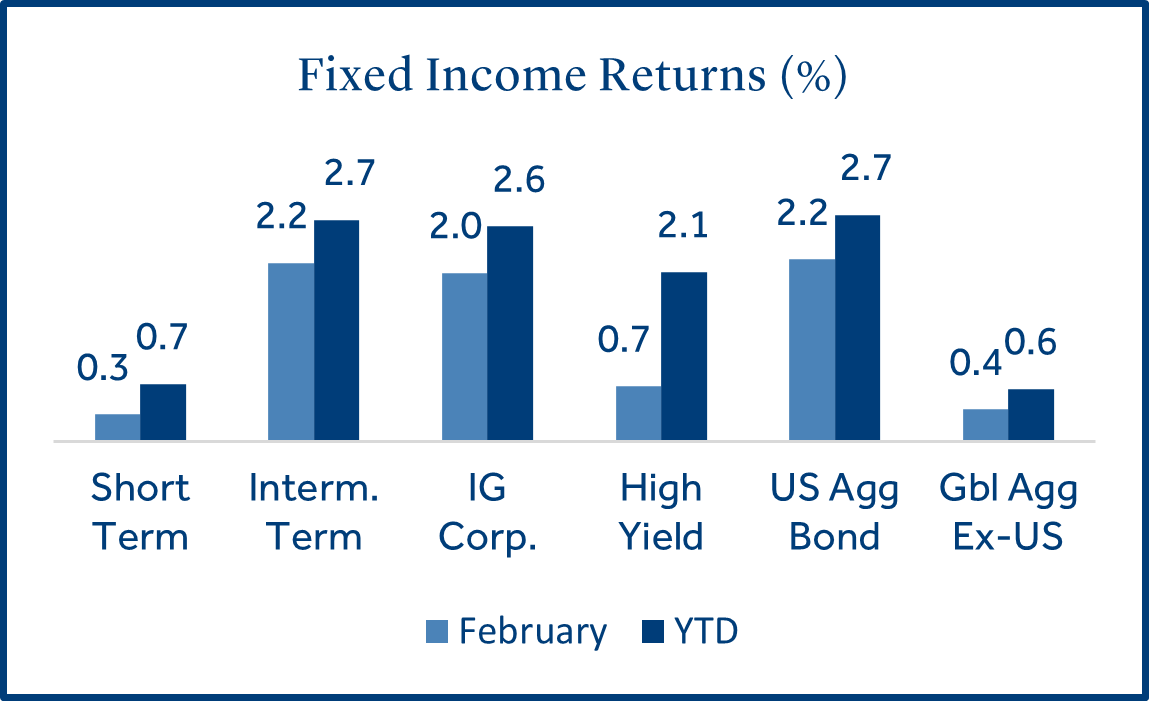

Bond returns were positive as investor demand for safety increased.

The 10-year Treasury yield has declined steadily since peaking at 4.79% in January. Most recently, an unexpected slowdown in the services sector and a dip in U.S. home sales likely pushed yields lower.

- Longer rates decline as shorter rates hold steady: Short-term rates were stable as the Fed continued to digest inflation and labor market data. The 10-year bond yield declined by -0.34% in February as recent data cast doubt about the strength of the U.S. economy.

- Investment grade (IG) corporate bonds topped high yield: IG bonds (rated BBB and above) gained +2.0% in February. The yield premium (credit spread) for IG bonds over Treasuries remained near a 20-year low but IG bond yields continued to sit at multiyear highs (above 5%)1. If interest rates and credit spreads remain steady, potential bond returns should remain attractive.

Equity Valuations

Investor enthusiasm for large cap growth stocks propelled valuations to generational highs.

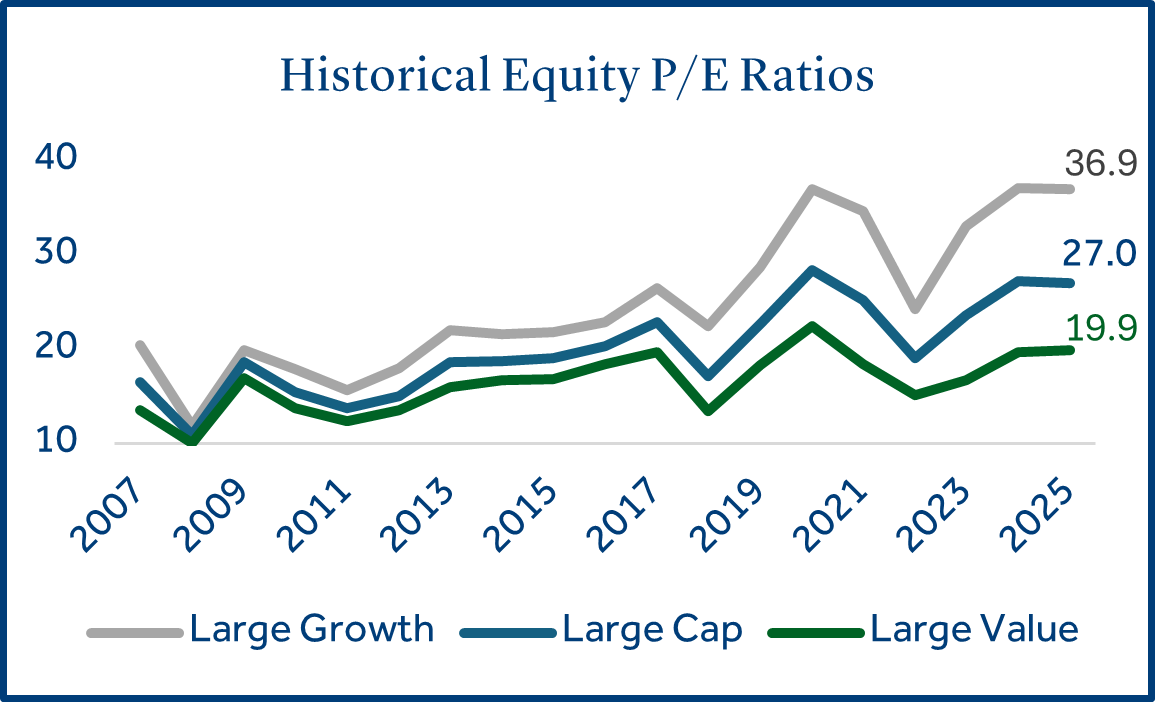

U.S. large cap stocks entered 2025 with their highest price-to-earnings (P/E) ratio in 20 years. Although high valuations are not always a predictor of lower stock prices, they may limit return potential and lead to increased volatility.

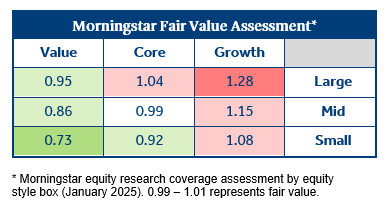

- Price multiples (P/E) of high growth stocks increased rapidly with the emergence of AI: Growth stocks outperformed for the last five years, and their P/E ratio hit 37X, compared to 20X for value stocks2. Should earnings growth broaden beyond the largest technology stocks while the U.S. economy remains in expansion, it could be supportive of value stocks in 2025.

- Growth stocks are trading at a significant premium to value stocks: Strong technology company profits and high investor demand for AI-related stocks has created a gap between the valuations of growth and value stocks. The valuation premium is the widest between large growth stocks (most expensive) and small value stocks (least expensive).

Department of Government Efficiency (DOGE)

The new administration has focused on spending cuts early in its tenure.

DOGE is a temporary special commission of the Trump administration established by an executive order. Its purpose is to reduce federal spending and to improve government efficiency.

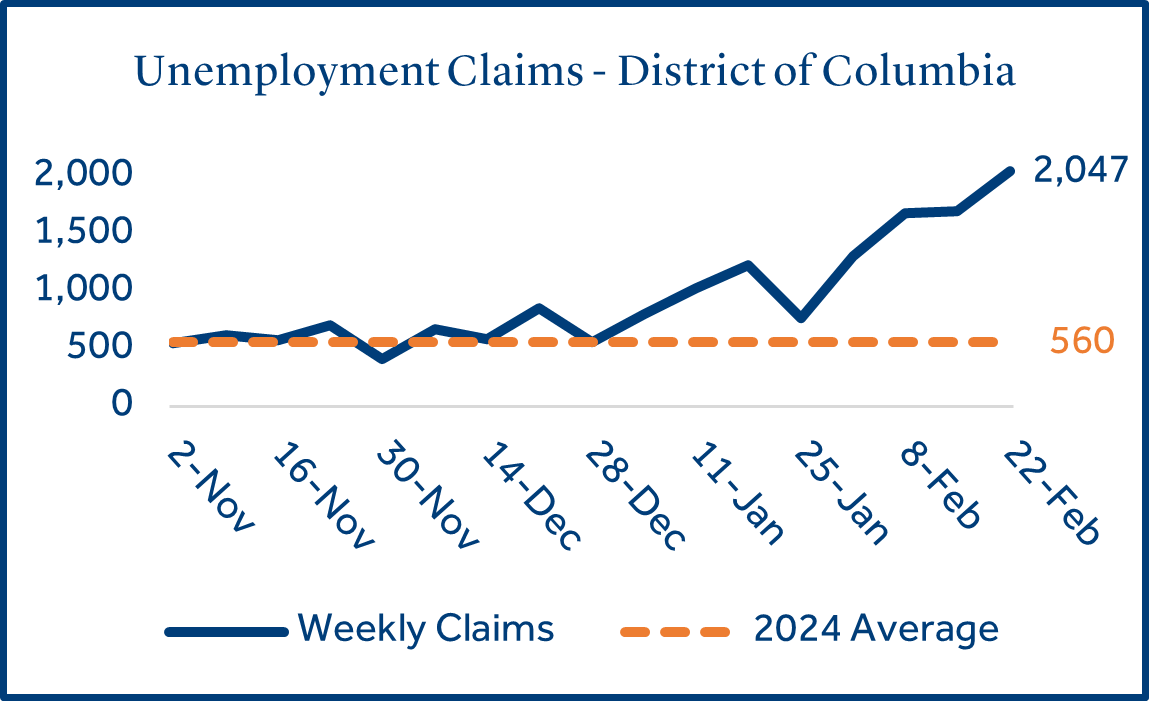

- Federal job reductions are rising as DOGE seeks to decrease government expenses: Approximately 75k government employees have accepted early retirement offers and 26k have been terminated. As the nation’s largest employer, some economists have predicted government job losses could reach 300k.

- The President has expressed support for a potential DOGE dividend payment: The potential payment assumes that DOGE would meet its $2 trillion savings goal and 20% ($400 billion) would be divided among 80 million taxpayer households ($5,000 per household). Since the dividend would be funded by dollars that are already appropriated, supporters believe it would not worsen inflation3. Any plan would need to be approved by Congress.

- DOGE job cuts could lead to an increase in the unemployment rate: Some economists estimate total job losses across the economy related to DOGE actions could reach 500k, which would equate to roughly 25% of the two million jobs created in 2024. Based on current labor market trends, 500k job losses could increase the unemployment rate by as much as +0.3%1.

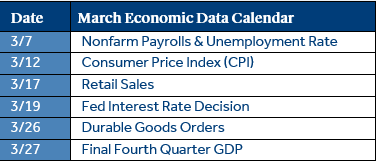

Economic Calendar

U.S. economic data reported during February was generally softer than expected.

Weaker than expected economic data has led to some investors reassessing the likelihood of a soft-landing for the economy. Consumer confidence fell by the most since 2021 as U.S. consumers were more pessimistic about the labor market, business conditions and inflation.

- January job growth was below expectations: +143k new jobs were created in January, below the forecast for +169k. However, the lower than expected number in January was offset by an upward revision to December new jobs which increased from +256k to +307k. Average hourly earnings, a closely watched inflationary gauge by the Fed, increased +4.1% over the past year versus estimates of +3.7%.

- Retail sales declined for the first time since August: January retail sales fell -0.9% and missed forecasts (-0.2%). It was a poor month overall for consumer spending, but some have speculated harsh weather conditions across the country may have played a role in the decline.

- CPI inflation accelerated during the month: Prices rose more than forecasted in January (+3.0% annualized) as inflation edged higher for the fourth consecutive month. The recent trend of higher inflation combined with the upward surprise in January hourly earnings could be a headwind for the Fed to lower rates. Interest rate futures currently forecast a 93% probability the Fed will leave short-term rates unchanged in March4.

Data and rates used were indicative of market conditions as of the date shown. Opinions, estimates, forecasts, and statements of financial market trends are based on current market conditions and are subject to change without notice. This material is intended for general public use and is for educational purposes only. By providing this content, Park Avenue Securities LLC is not undertaking to provide any recommendations or investment advice regarding any specific account type, service, investment strategy or product to any specific individual or situation, or to otherwise act in any fiduciary or other capacity. Please contact a financial professional for guidance and information that is specific to your individual situation. Indices are unmanaged and one cannot invest directly in an index. Links to external sites are provided for your convenience in locating related information and services. Guardian, its subsidiaries, agents, and employees expressly disclaim any responsibility for and do not maintain, control, recommend, or endorse third-party sites, organizations, products, or services and make no representation as to the completeness, suitability, or quality thereof. Past performance is not a guarantee of future results.

All investments involve risks, including possible loss of principal. Equities may decline in value due to both real and perceived general market, economic, and industry conditions. Fixed income securities involve interest rate, credit, inflation, and reinvestment risks, and possible loss of principal. As interest rates rise, the value of fixed income securities falls. Low-rated, high yield bonds are subject to greater price volatility. Investing in securities of smaller companies tends to be more volatile and less liquid than securities of larger companies. Investing in foreign securities may involve heightened risk including currency fluctuations, less liquid trading markets, greater price volatility, political and economic instability, less publicly available information and changes in tax or currency laws. Such risks are enhanced in emerging markets.

Asset class returns sourced from Morningstar Direct. Asset categories listed correspond to the following underlying indices: Large Cap (S&P 500), Small Cap (Russell 2000), Non-US Dev (MSCI EAFE), Emerging Markets (MSCI EM), Bonds (Bloomberg US Aggregate Bond), Short Term (Bloomberg Short Treasury), Intermediate-term (Bloomberg US Treasury), IG Corp (Bloomberg US Corp. Bond), High Yield (Bloomberg High Yield Corporate), Global Agg ex-US (Bloomberg Global Agg Ex US – Hedged), Large Growth (Russell 1000 Growth), Large Value (Russell 1000 Value), Magnificent 7 (Alphabet, Amazon, Apple, Meta, Microsoft, NVIDIA, and Tesla).

Treasury Yields sourced from the U.S. Department of the Treasury.

Inflation (CPI) sourced from the U.S. Bureau of Labor Statistics.

Unemployment claims sourced from the Department of Labor.

1 Source: Bloomberg

2 Source: Morningstar

3 Source: NBC News

4 Source: CME FedWatch Tool

The Consumer Price Index (CPI) examines the weighted average of prices of a basket of consumer goods and services, such as transportation, food and medical care and is a commonly used measure of the rate of inflation.

Retail Sales represents the level of retail sales directly to U.S. consumers.

Durable Goods measure the cost of orders received by U.S. manufacturers of goods meant to last at least three years.

Fed Funds Rate: Short-term target interest rate set by the Federal Open Market Committee (FOMC); the policy making committee of the Federal Reserve. It is the interest that banks and other depository institutions lend money on an overnight basis.

S&P 500 Index: Index is generally considered representative of the stock market as a whole. The index focuses on the large-cap segment of the U.S. equities market.

Russell 2000 Index: Index measures performance of the small-cap segment of the U.S. equity universe.

MSCI EAFE Index: Index measures the performance of the large and mid-cap segments of developed markets, excluding the U.S. & Canada.

MSCI EM Index: Index Measures the performance of the large and mid-cap segments of emerging market equities.

Bloomberg US Aggregate Bond Index: Index measures the performance of investment grade, U.S. dollar-denominated, fixed-rate taxable bond market, including Treasuries, government-related and corporate securities, MBS, ABS, and CMBS.

Park Avenue Securities LLC (PAS) is a wholly owned subsidiary of The Guardian Life Insurance Company of America (Guardian). 10 Hudson Yards, New York, NY 10001. PAS is a registered broker-dealer offering competitive investment products, as well as a registered investment advisor offering financial planning and investment advisory services. PAS is a member of FINRA and SIPC.

PAS12603

7069921.8