Monthly Market Commentary – January 2025

Monthly Market Commentary – January 2025

Market Update

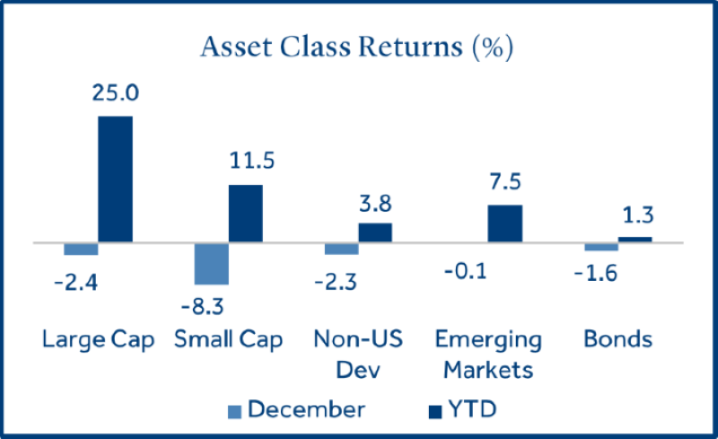

Stocks and bonds faced headwinds in December but finished the year with positive returns across the board.

The S&P 500 Index notched several all-time highs in early December before retreating modestly into year-end. The Federal Reserve (Fed) cut short-term interest rates by -0.25% during their policy meeting, but a cautious tone about the future direction of interest rate cuts created some uncertainty to finish the month. Against this backdrop:

- Large caps outperformed small caps as volatility returned: Large cap stocks (S&P 500 Index) returned -2.4% but outperformed small cap stocks (Russell 2000 Index) which declined -8.3%. Small caps underperformed in part due to higher borrowing rates, as they generally rely on debt financing to fund growth.

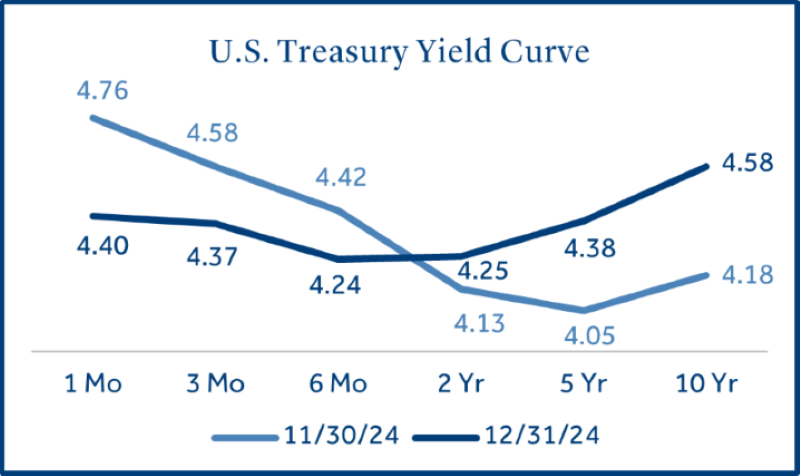

- Bonds posted negative returns as long-term rates increased: Bonds (Bloomberg US Aggregate Bond Index) returned -1.6% as the 10-year U.S. Treasury yield increased from 4.18% to 4.58% (+0.40%).

- Emerging markets outperformed non-U.S. developed market: Emerging market stocks (MSCI EM Index) declined -0.1% and topped non-U.S. developed market stocks (MSCI EAFE Index) which returned -2.3%. Non-U.S. developed market stocks were lower due to uncertainly around economic growth and the future path of interest rates.

U.S. Equities

The prospect of fewer interest rate cuts from the Fed and rising Treasury yields weighed on stocks.

The S&P 500 Index declined -3% on the day of the Fed’s December policy meeting after the U.S. central bank reset expectations for only two rate cuts in 2025. Longer-term interest rates moved higher on the news which also weighed on stocks for the remainder of the month.

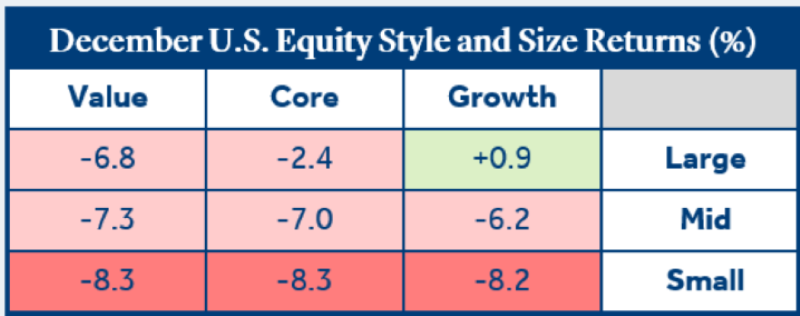

- Large cap growth stocks outperformed in a return to a familiar pattern: The “Magnificent seven” stocks (Alphabet, Amazon, Apple, Meta, Microsoft, NVIDIA, and Tesla) which represent the largest companies in the S&P 500 Index returned +5.5% in December. Expectations for above average earnings growth and the potential for a favorable regulatory environment in 2025 boosted returns.

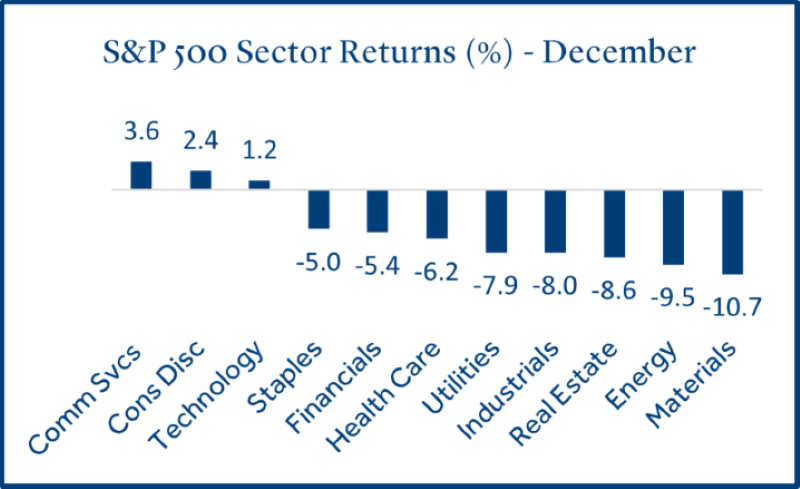

- Dividend paying value stocks lagged due to rising yields: Sectors with the highest dividend yields (Energy, Real Estate and Utilities) were amongst the worst returners during the month1. A cautious outlook on Fed interest rate cuts and rising Treasury yields weighed on returns.

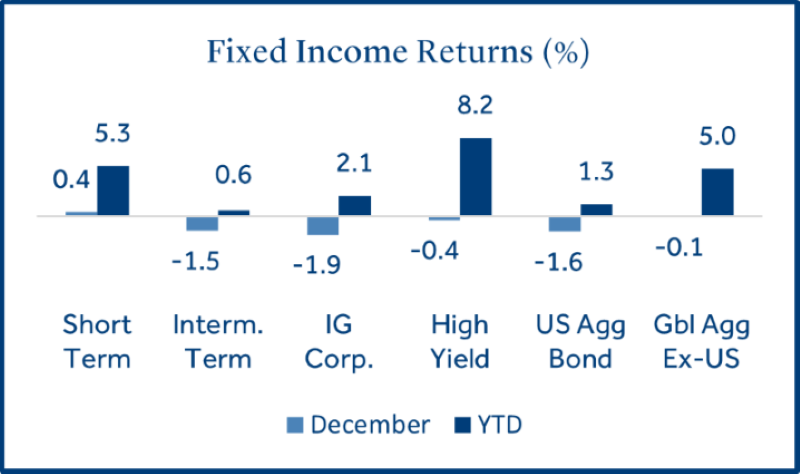

Fixed Income

Bond returns were mostly negative as Treasury yields increased during the month.

The Treasury yield curve steepened in December as the Fed lowered short-term rates by -0.25% and longer-term yields rose on the potential threat of rising inflation.

- Short-term bonds outperformed long-term bonds: Short-term bonds, which are more closely correlated to the Fed’s interest rate policy than long-term bonds, performed well on the heels of the December rate cut.

- High Yield (HY) bonds outperformed their investment grade (IG) peers: HY bonds (rated BB and below) fell -0.4% compared to a -1.9% decline for IG (rated BBB and above). HY bonds generally have a shorter maturity (compared to IG bonds) and were therefore less impacted by rising interest rates.

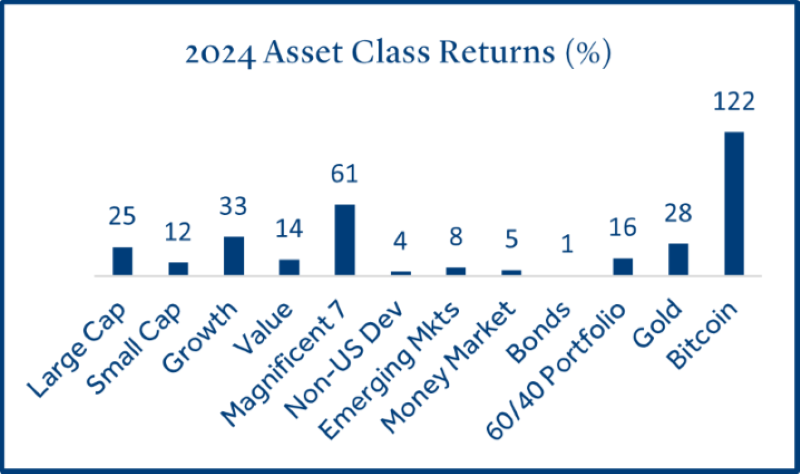

2024 Capital Market Review

Asset class returns were mostly positive in 2024 led by U.S. large cap growth stocks and alternatives.

Economic growth was solid as GDP averaged 2.5% over the first three quarters of the year. Strong job growth, a resilient consumer, lower inflation and an active Fed all provided support to capital markets. Within this framework risk assets performed well.

- U.S. large cap stocks led traditional asset class returns: Large cap growth stocks led equity returns for the second consecutive year (+43% in 2023) and were led higher by the magnificent seven and investor enthusiasm about artificial intelligence (AI). NVIDIA rose 171% in 2024 and was a standout in the large growth space due to their expertise in AI chips.

- Bond returns were muted as rates climbed: The current yield (4.9%) on the US Aggregate Bond Index is now the highest in over a decade. However, rising interest rates in 2024, which have an inverse effect on bond prices, weighed on the overall bond market. High Yield (+8.2%) and short-term bonds (+5.3%) posted stronger performance in 2024 due to their lower interest rate sensitivity.

- Cash alternatives continued to rise on the threat of higher inflation: Gold and bitcoin performed well as investors fretted about the impact of inflation on traditional currencies. Gold is often viewed as a safe haven with the potential to buffer losses during times of market stress. Bitcoin has become popular due to its high recent returns but those have come with the side-effect of extremely high volatility2.

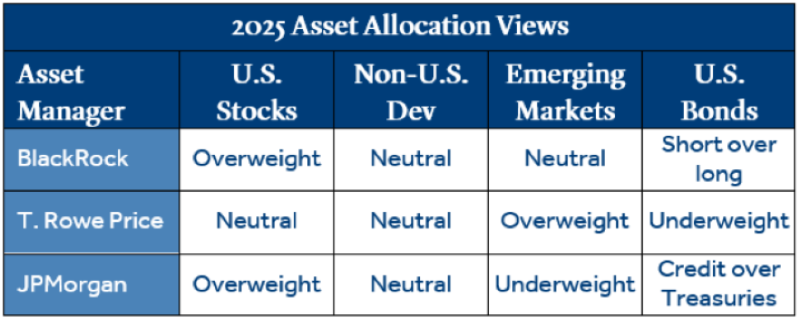

2025 Asset Manager Outlook

Asset manager outlooks are mixed for 2025 but mostly favor U.S. over international equities.

Leading managers (BlackRock, T. Rowe Price, and JPMorgan) recently released 2025 market outlooks which are highlighted below.

- BlackRock is constructive on risk assets and favors U.S. stocks: BlackRock believes the buildout and adoption of AI will create opportunities across sectors and industries. A robust economy, broad earnings growth, and a high-quality tilt underpin their conviction in U.S. stocks. They see valuations for large cap tech stocks backed by strong earnings, and less lofty valuations for many other sectors3.

- T. Rowe Price believes higher inflation could dampen bond returns: T. Rowe Price thinks the U.S. economy should continue to outperform peers due to fiscal and monetary support. However, higher goods prices and volatility in shelter costs could keep inflation above the Fed’s 2% target. This may lead to fewer rate cuts in 2025 and result in higher long-term Treasury yields (a headwind for bonds). Additionally, they are expecting credit spreads to widen modestly from historically narrow levels in 20244.

- JPMorgan stressed the importance of diversification: Following two strong years of outperformance from U.S. stocks, valuations have become elevated, and the economy could slow to a more gradual pace of growth. Although they believe this is unlikely to trigger a recession, it does leave the economy more vulnerable to shocks from uncertain fiscal and monetary policy5.

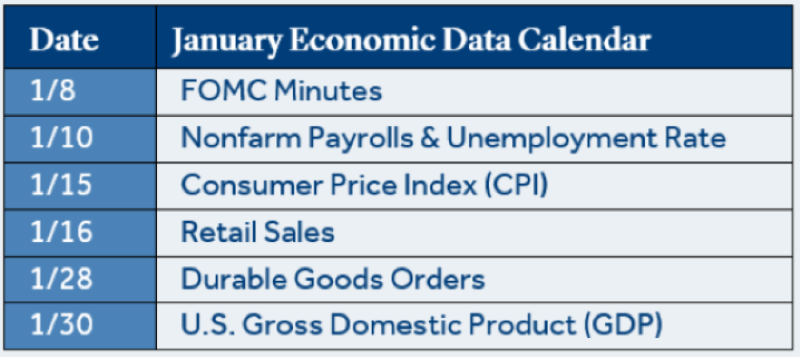

Economic Calendar

U.S. job growth and consumer spending both topped expectations.

Job growth and consumer spending were crucial to the U.S. economy avoiding a recession in 2024, as both metrics were stronger than many economists expected. Employers added about two million new jobs during the year and retail sales topped forecasts for six consecutive months (June - November).

- U.S. job growth rebounded in November and exceeded expectations: +227k new jobs were created in November, versus a forecast for +214k. This was a significant increase from October (+36k) but is likely a “catch up” in hiring due to the numerous employee strikes and hurricanes that slowed job growth in October.

- Retail sales have topped forecasts for six straight months: November retail sales rose +0.7%, versus a forecast for +0.6% and marked the second highest monthly reading since January 2023. A strong labor market with low historical layoffs and strong wage growth has supported consumer spending.

- The Fed reduced expectations for 2025 rate cuts due to stubborn inflation: November inflation (CPI) was in line with forecasts (+2.7% annualized) but nevertheless has risen in two straight months. The Fed noted during their December meeting that economic growth was stronger than forecasted, while inflation was slightly higher. Given this assessment, the Fed now projects only two rate cuts in 2025, down from four expected rate cuts at their September meeting6.

o download the printable version, CLICK HERE.

Data and rates used were indicative of market conditions as of the date shown. Opinions, estimates, forecasts, and statements of financial market trends are based on current market conditions and are subject to change without notice. This material is intended for general public use and is for educational purposes only. By providing this content, Park Avenue Securities LLC is not undertaking to provide any recommendations or investment advice regarding any specific account type, service, investment strategy or product to any specific individual or situation, or to otherwise act in any fiduciary or other capacity. Please contact a financial professional for guidance and information that is specific to your individual situation. Indices are unmanaged and one cannot invest directly in an index. Links to external sites are provided for your convenience in locating related information and services. Guardian, its subsidiaries, agents, and employees expressly disclaim any responsibility for and do not maintain, control, recommend, or endorse third-party sites, organizations, products, or services and make no representation as to the completeness, suitability, or quality thereof. Past performance is not a guarantee of future results.

All investments involve risks, including possible loss of principal. Equities may decline in value due to both real and perceived general market, economic, and industry conditions. Fixed income securities involve interest rate, credit, inflation, and reinvestment risks, and possible loss of principal. As interest rates rise, the value of fixed income securities falls. Low-rated, high yield bonds are subject to greater price volatility. Investing in securities of smaller companies tends to be more volatile and less liquid than securities of larger companies. Investing in foreign securities may involve heightened risk including currency fluctuations, less liquid trading markets, greater price volatility, political and economic instability, less publicly available information and changes in tax or currency laws. Such risks are enhanced in emerging markets.

Asset class returns sourced from Morningstar Direct. Asset categories listed correspond to the following underlying indices: Large Cap (S&P 500), Small Cap (Russell 2000), Non-US Dev (MSCI EAFE), Emerging Markets (MSCI EM), Bonds (Bloomberg US Aggregate Bond), Short Term (Bloomberg Short Treasury), Intermediate-term (Bloomberg US Treasury), IG Corp (Bloomberg US Corp. Bond), High Yield (Bloomberg High Yield Corporate), Global Agg ex-US (Bloomberg Global Agg Ex US – Hedged), Growth (Russell 1000 Growth), Value (Russell 1000 Value), Magnificent 7 (Alphabet, Amazon, Apple, Meta, Microsoft, NVIDIA, and Tesla), Money Market (FTSE Treasury Bill 3 month), 60/40 portfolio (60% S&P 500 / 40% US Aggregate Bond), Gold (LBMA Gold Price PM), Bitcoin (S&P Bitcoin).

Treasury Yields sourced from the U.S. Department of the Treasury.

Inflation (CPI) sourced from the U.S. Bureau of Labor Statistics.

1 Source: Morningstar

2 Source: Morningstar. Three-year standard deviation (as of 12/31/24): US Agg Bond Index (7.8), LBMA Gold Price (12.6), S&P 500 Index (17.4), S&P Bitcoin (62.9).

3 Source: BlackRock, 2025 Global Outlook

4 Source: T. Rowe Price, 2025 Global Market Outlook

5 Source: JPMorgan, 2025 Year-Ahead Investment Outlook

6 Source: Federal Reserve Board

The Consumer Price Index (CPI) examines the weighted average of prices of a basket of consumer goods and services, such as transportation, food and medical care and is a commonly used measure of the rate of inflation.

Retail Sales represents the level of retail sales directly to U.S. consumers.

Durable Goods measure the cost of orders received by U.S. manufacturers of goods meant to last at least three years.

Fed Funds Rate: Short-term target interest rate set by the Federal Open Market Committee (FOMC); the policy making committee of the Federal Reserve. It is the interest that banks and other depository institutions lend money on an overnight basis.

S&P 500 Index: Index is generally considered representative of the stock market as a whole. The index focuses on the large-cap segment of the U.S. equities market.

Russell 2000 Index: Index measures performance of the small-cap segment of the U.S. equity universe.

MSCI EAFE Index: Index measures the performance of the large and mid-cap segments of developed markets, excluding the U.S. & Canada.

MSCI EM Index: Index Measures the performance of the large and mid-cap segments of emerging market equities.

Bloomberg US Aggregate Bond Index: Index measures the performance of investment grade, U.S. dollar-denominated, fixed-rate taxable bond market, including Treasuries, government-related and corporate securities, MBS, ABS, and CMBS.

Park Avenue Securities LLC (PAS) is a wholly owned subsidiary of The Guardian Life Insurance Company of America (Guardian). 10 Hudson Yards, New York, NY 10001. PAS is a registered broker-dealer offering competitive investment products, as well as a registered investment advisor offering financial planning and investment advisory services. PAS is a member of FINRA and SIPC.

PAS12601

2024-7069921.5 (Exp. 12/26)