Monthly Market Commentary - December 2024

Monthly Market Commentary - December 2024

Market Update

Domestic stocks continued their strong momentum following the U.S. presidential election.

U.S. equities surged in response to the election results as small caps rallied +5.8% the following Wednesday and the S&P 500 Index hit a record high several days later. U.S. economic data continued to exhibit strength, and the Federal Reserve (Fed) reiterated they would likely take a gradual path to lower interest rates. Against this backdrop:

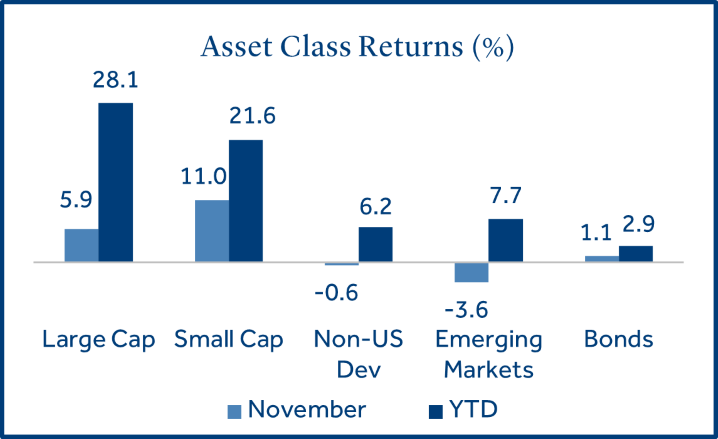

- Small cap stocks outperformed large caps on economic optimism: Small caps (Russell 2000 Index) gained +11.0% and outperformed large caps (S&P 500 Index), which returned +5.9%. Small cap stocks posted strong gains on optimism they could benefit from the pro-business policies of the new administration.

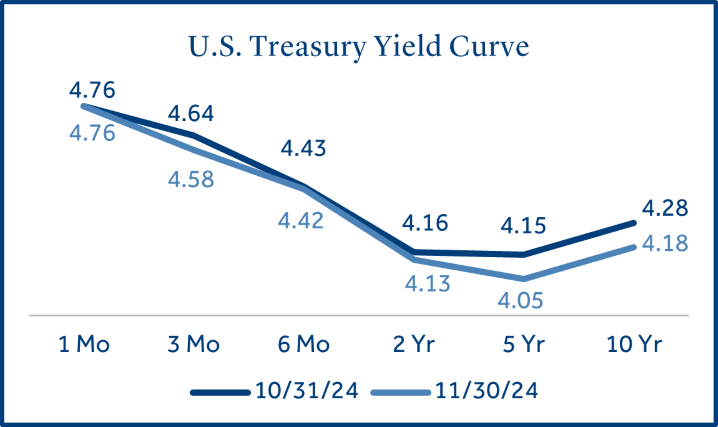

- Bonds posted positive gains as Treasury yields fell modestly: Bonds (Bloomberg US Aggregate Bond Index) returned +1.1% as yields were slightly lower during the month. The 10-year U.S. Treasury yield declined from 4.28% to 4.18% (-0.10%).

- Non-U.S. equities underperformed on tariff concerns: Non-U.S. developed market stocks (MSCI EAFE Index) declined -0.6% but fared better than Emerging Market equities (MSCI EM Index) which returned -3.6%. The potential for U.S. tariffs, slowing exports to China, and escalation of the Russia-Ukraine war weighed on non-U.S. equity performance.

U.S. Equities

The S&P 500 continued to trade near all-time highs on prospects for economic growth.

Stocks continued their climb in November, boosted by a resilient labor market, strong consumer spending, and Fed rate cuts.

- Small cap stocks rallied as equity breadth widened: Recent gains in small caps were likely driven by the prospect of lower rates and a favorable economic landscape. Some investors also contend small caps could be less impacted by the potential for new tariffs compared to larger global corporations.

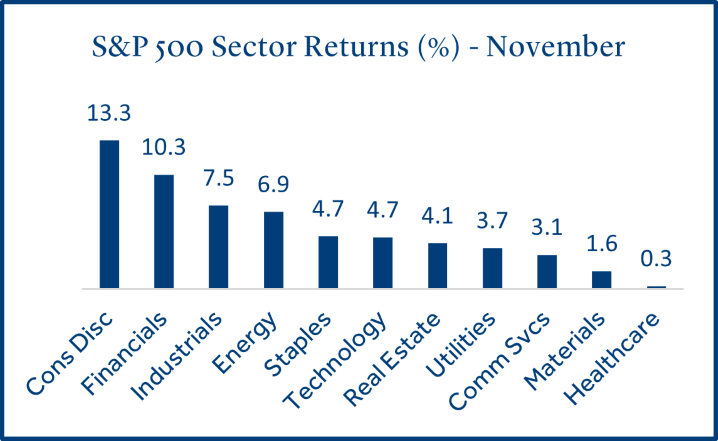

- Cyclical sectors outperformed on optimism around the U.S. economy: Sectors that are dependent on a growing economy outperformed in November. Consumer discretionary benefitted from strong retail sales and a post-election rally in Tesla shares. Financials and Energy rallied on the potential for deregulation and prospects for increased merger and acquisition (M&A) activity.

- Defensive sectors were out of favor during the November rally: Healthcare was the worst performing sector as changes in government leadership often create regulatory uncertainty. Other defensive, higher dividend paying sectors like utilities and consumer staples lagged the overall market as they are less dependent upon a strong economy and therefore were out of favor as equities rallied.

Fixed Income

Bond returns were positive as Treasury yields declined modestly during the month.

Intermediate and longer-term interest rates, which are driven by market supply and demand for bonds, declined during the month as investors anticipated the new administration’s support for favorable business policy.

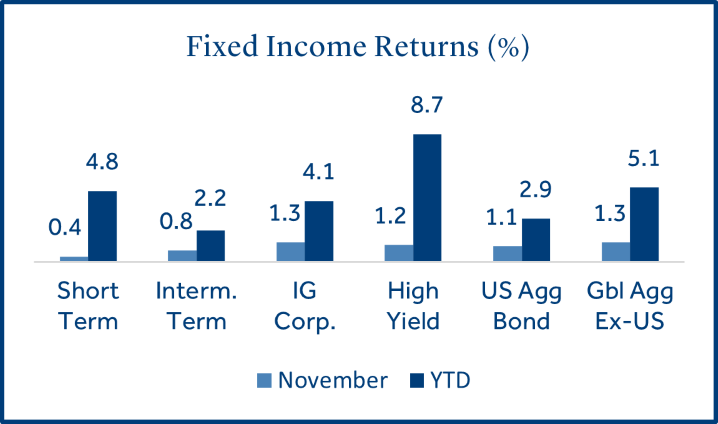

- Long-term bonds outperformed short-term peers: Five and ten-year yields declined more than short-term yields, which boosted longer-term bond returns. Bond yields were volatile in November as investors digested the incoming administration and recent inflation data1.

- Investment grade (IG) bonds edged out high yield (HY). IG bonds (rated BBB and above) gained +1.3% versus +1.2% for HY (rated BB and below). As IG and HY corporate bonds have performed well in 2024, credit spreads (the premium in yield compared to a Treasury bond of the same maturity) recently touched their lowest levels in over 15 years.2

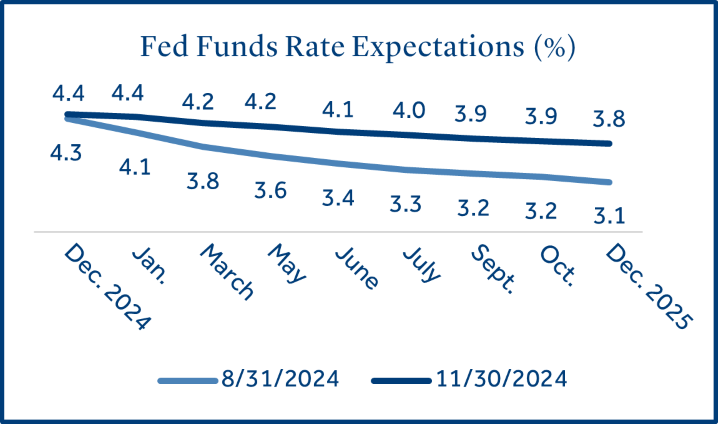

Federal Reserve

The Fed could lower short-term interest rates more slowly as economic data remains on solid ground.

Strong economic reports since the Fed’s first interest rate cut in September may lead to a more cautious approach going forward.

- As expected, the Fed cut short-term rates by -0.25% at their November policy meeting: Fed officials unanimously lowered the fed funds target range to 4.50% to 4.75% as they believe the economy is on the right track. The Fed is optimistic current policy will support the labor market and allow further progress on inflation.

- Interest rate futures are mixed on a Fed rate cut in December: There is currently a 64% probability of a -0.25% rate cut at the December 18 Fed policy meeting3. This is a much less certain forecast compared to the November forecast and highlights the market’s uncertainty about the Fed’s next decision.

- Interest rate cuts are expected at a more gradual pace: Fed officials indicated they may slow the pace of rate cuts as they determine the appropriate neutral rate (the interest rate that balances economic growth and inflation). Some believe a slower path for rates supports a “soft landing” for the economy. Interest rate futures forecasts for 2025 have adjusted significantly higher in response to the latest Fed sentiment1.

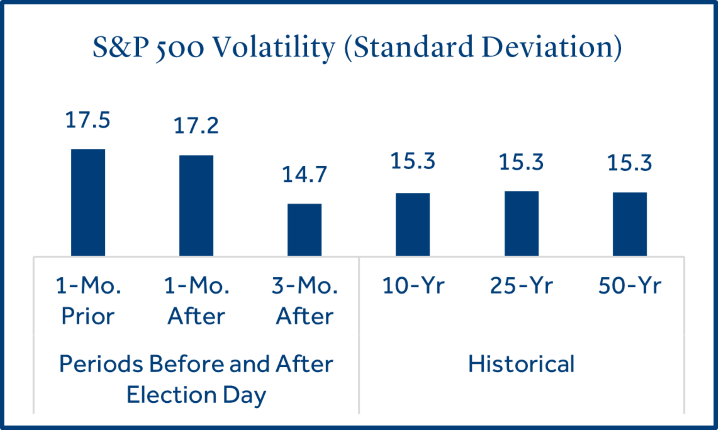

U.S. Presidential Election

Market volatility has been higher in periods around U.S. presidential elections.

The 2024 presidential race was close until the final votes were tallied, and this uncertainty contributed to higher volatility during November. It has been common for market strain to increase shortly before and after election periods although it has generally subsided within one to three months.

- Stocks have experienced higher volatility in periods around presidential elections: A recent study analyzed the last 24 presidential elections and found that equity market risk was higher in the months directly before and after the elections4.

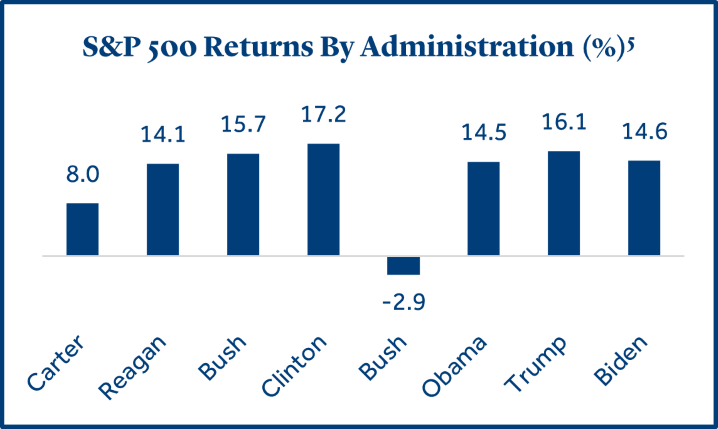

- Equity performance has been strong under both parties: Many different factors have the potential to affect equity market performance in addition to government policy. Longer-term, stocks have rewarded investors under the leadership of both parties.

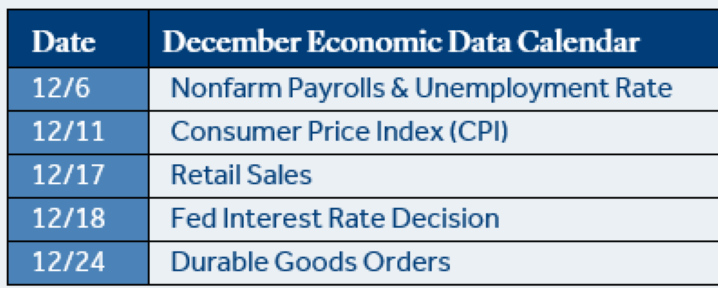

Economic Calendar

The U.S. economy grew by +2.8% during the third quarter, driven by consumer spending.

Gross domestic product (GDP) increased at a solid pace during the quarter, although results slightly missed forecasts (+3.0%). Consumer spending was the top contributor to GDP and reflected increased spending on both goods and services.

- Retail sales topped forecasts and highlight resiliency in consumer spending: October retail sales increased +0.4% for the month and exceeded estimates (+0.3%) while September retail sales were revised upward to +0.8% (from +0.4%). It was a solid start to the fourth quarter and could be an early sign of a strong holiday shopping season.

- U.S. job growth slowed last month but was likely due to unusual circumstances: Only +12k new jobs were created in October (+100k jobs forecasted) but a recent strike at Boeing subtracted -44k jobs while hurricanes in the U.S. also weighed on job growth. A bright spot in the report was that unemployment held steady at 4.1%, in line with expectations. Initial jobless claims (reported weekly) recently fell to their lowest level since April and could be a positive sign for job growth in November.

- Inflation (CPI) increased modestly during October: Inflation was in-line with forecasts but provided mixed signals. Annualized inflation rose +2.6%, increasing from +2.4% last month, and could show that the Fed’s progress is stalling. However, inflation has been on a steady downward path for over two years and monthly data has the potential to be bumpy.

To download the printable version, CLICK HERE.

Data and rates used were indicative of market conditions as of the date shown. Opinions, estimates, forecasts, and statements of financial market trends are based on current market conditions and are subject to change without notice. This material is intended for general public use and is for educational purposes only. By providing this content, Park Avenue Securities LLC is not undertaking to provide any recommendations or investment advice regarding any specific account type, service, investment strategy or product to any specific individual or situation, or to otherwise act in any fiduciary or other capacity. Please contact a financial professional for guidance and information that is specific to your individual situation. Indices are unmanaged and one cannot invest directly in an index. Links to external sites are provided for your convenience in locating related information and services. Guardian, its subsidiaries, agents, and employees expressly disclaim any responsibility for and do not maintain, control, recommend, or endorse third-party sites, organizations, products, or services and make no representation as to the completeness, suitability, or quality thereof. Past performance is not a guarantee of future results.

All investments involve risks, including possible loss of principal. Equities may decline in value due to both real and perceived general market, economic, and industry conditions. Fixed income securities involve interest rate, credit, inflation, and reinvestment risks, and possible loss of principal. As interest rates rise, the value of fixed income securities falls. Low-rated, high yield bonds are subject to greater price volatility. Investing in securities of smaller companies tends to be more volatile and less liquid than securities of larger companies. Investing in foreign securities may involve heightened risk including currency fluctuations, less liquid trading markets, greater price volatility, political and economic instability, less publicly available information and changes in tax or currency laws. Such risks are enhanced in emerging markets.

Asset class returns sourced from Morningstar Direct. Asset categories listed correspond to the following underlying indices: Large Cap (S&P 500), Small Cap (Russell 2000), Non-US Dev (MSCI EAFE), Emerging Markets (MSCI EM), Bonds (Bloomberg US Aggregate Bond), Short Term (Bloomberg Short Treasury), Intermediate-term (Bloomberg US Treasury), IG Corp (Bloomberg US Corp. Bond), High Yield (Bloomberg High Yield Corporate), Global Agg ex-US (Bloomberg Global Agg Ex US – Hedged).

Treasury Yields sourced from the U.S. Department of the Treasury.

Inflation (CPI) sourced from the U.S. Bureau of Labor Statistics.

1 Source: Bloomberg

2 Source: Federal Reserve Bank of St. Louis

3 Source: CME FedWatch Tool

4 Source: T. Rowe Price

5 Source: Morningstar. Returns are annualized for each President’s term and correspond to the following calendar years: Carter (1977-1980), Reagan (1981-1988), George H. W. Bush (1989-1992), Clinton (1993-2000), George W. Bush (2001-2008), Obama (2009-2016), Trump (2017-2020), Biden (2021-11/30/2024).

The Consumer Price Index (CPI) examines the weighted average of prices of a basket of consumer goods and services, such as transportation, food and medical care and is a commonly used measure of the rate of inflation.

Retail Sales represents the level of retail sales directly to U.S. consumers.

Durable Goods measure the cost of orders received by U.S. manufacturers of goods meant to last at least three years.

Fund Funds Rate: Short-term target interest rate set by the Federal Open Market Committee (FOMC); the policy making committee of the Federal Reserve. It is the interest that banks and other depository institutions lend money on an overnight basis.

S&P 500 Index: Index is generally considered representative of the stock market as a whole. The index focuses on the large-cap segment of the U.S. equities market.

Russell 2000 Index: Index measures performance of the small-cap segment of the U.S. equity universe.

MSCI EAFE Index: Index measures the performance of the large and mid-cap segments of developed markets, excluding the U.S. & Canada.

MSCI EM Index: Index Measures the performance of the large and mid-cap segments of emerging market equities.

Bloomberg US Aggregate Bond Index: Index measures the performance of investment grade, U.S. dollar-denominated, fixed-rate taxable bond market, including Treasuries, government-related and corporate securities, MBS, ABS, and CMBS.

Park Avenue Securities LLC (PAS) is a wholly owned subsidiary of The Guardian Life Insurance Company of America (Guardian). 10 Hudson Yards, New York, NY 10001. PAS is a registered broker-dealer offering competitive investment products, as well as a registered investment advisor offering financial planning and investment advisory services. PAS is a member of FINRA and SIPC.

PAS018148

2024-7069921.4 (Exp. 11/26)